The FICO Score which is generally used has a range from 300 to 850 and can have an effect in what credit is available to and individual, how much interest an individual will pay and even things such as utilities and mobile phone bills. For an individual who understands ‘what is good credits range’, this won’t be much problem. Having an understanding of what is good credit score range can have a great impact on your future. This score is what lenders will use to know how trustworthy and reliable you are. FICO Score is used for 90% of the credit decisions.

Understanding good credit range will give an edge in determining what lenders use to link ranges of values with some other characteristics and metrics which will help them make more informed lending decisions easily. With a good credit range of 800 and above, the applicant will be entitled to the best possible interest rate from lenders. This will indicate an exceptional FICO score which is well above the average credit. Every individual in this range will experience an easy approval process when searching for a loan. About 1% of consumers who fall within this range are very likely to become delinquent at any point in time.

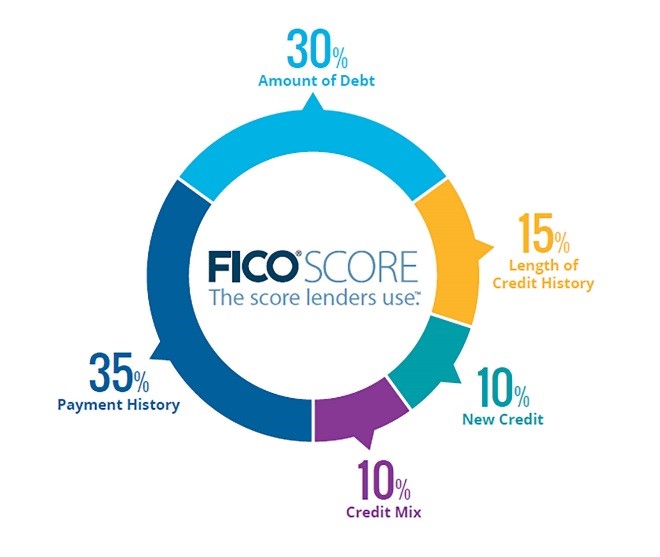

In a bid to understand what is good credit score range, it is known that individuals with a score between 740 and 799 have a very good FICO score which is above the average credit. Individuals within this range are likely to get a better than average interest rate from lenders. About 2% of individuals within this range are likely to become delinquent in future. For an individual with a good credit between 670 and 739, this is seen as a median credit range. Consumers with ratings within this range are seen as an acceptable borrower. About 8% of consumers with a good credit score in this range is likely to become more delinquent in future. Your credit number is part of what will be considered by a lender when judging how responsible and trustworthy you are. But it should be known that this rating does not consider your income, length of employment, alimony or child support payments etc. Having a very short payment history or a new credit can reduce your FICO score. It doesn’t necessarily have to be from missed payments or used up cards. A good credit score is calculated using 35% of payment history, 30% of the amount owed on a loan or debt, 15% of the Length of history, 10% of the new loan and also 10% of the credit mix being used.

For a FICO score with a range from 300 to 850, 700 and above is seen as a good credit score while for someone with a score of 800 and above is seen as an excellent score. But it is known that most score fall between the range of 600 and 750. The higher score shows an individual has an understanding of what is good credit score range and will help in making better decisions which will give lenders more confident that you will make the required payments within the agreed period. Understanding what is good credit score range will help you know how credits scores are used by lenders such as banks in providing mortgage loans, card and also car dealerships financing for auto purchases, to make decisions about whether or not to offer you credit (such as a card or loan) and what the terms of the offer (which will include the high or low-interest rate or down payment) should be. There are so many different types of credit that are being used. But the FICO scores and VantageScore are two very common types of credit scores. There is also some industry specific rating which exists. One of the most used and very popular types of credit score is FICO Score which was created by Fair Isaac Corporation. FICO score is widely used by many lenders and has a range from 300 to 850. Any FICO Score which is above 670 is seen as a good credit while using this model while any score above 800 is seen as an exceptional score.