A construction loan is a short-term, interim loan for financing the cost of constructing your property. A broad range of potential borrowers, from individuals building their dream homes to property developers aiming for commercial spaces, gain access to unique benefits, making it often an attractive financing option. Here are the top reasons why you should consider a construction loan.

Customization and Creative Control

The primary appeal of a construction loan lies in the level of customization and control it offers over your property. The loan allows you to design every corner, build to your specifications, and create a unique space that mirrors your style and meets your exact needs.

Increase in Property Value

Also, construction or renovation significantly boosts property value. A well-planned construction project can yield substantial returns on investment when you refinance or sell the property. By availing of a construction loan, you can secure the finances necessary to enhance the potential value of your asset in the future.

Reduced Competition

Opting for a construction loan reduces the competition for property acquisition, particularly in prime locations. Most homebuyers prefer buying constructed properties, creating a smaller pool of competitors for construction sites. This scenario could make your ideal location more accessible and provides a chance to create a perfect commercial property or home in a less competitive environment.

Lower Interest Rates

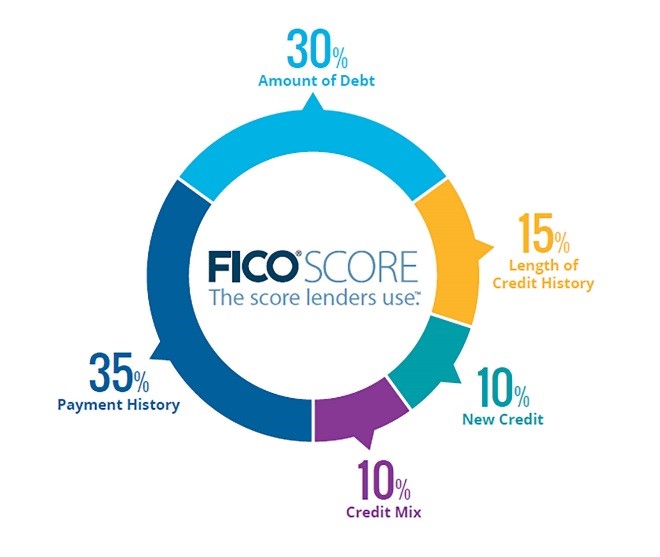

Construction loans typically come with variable interest rates. Average construction loan interest rate is around 4.5%, however, these rates tend to fluctuate depending on various factors including the prime rate, your credit score, and the overall lending environment. Even so, these loans offer potentially lower interest rates than most traditional mortgage loans at the time of writing. Thus, taking a construction loan can result in significant savings during your project. Once the project is complete, you might consider refinancing the loan for a fixed-rate mortgage depending on current market rates.

Interest-Only Payments During Construction

Another benefit of construction loans is the payment structure during the construction phase. Most of these loans require only interest payments, greatly reducing your financial burden during this period. Upon completion, when you move into the newly constructed home or open your commercial property, you can begin full principal and interest payments.

Access to Construction Expertise

Lenders often take Charge in overseeing the construction projects they finance, guaranteeing the successful completion of their investment. This involvement means an added layer of expert support for borrowers, from obtaining permits and budgeting to coordinating with professionals.

Environmental And Energy Efficiency

Financial benefits aside, construction loans also encourage the use of modern, eco-friendly construction techniques and materials. These practises enhance energy efficiency resulting in significant cost savings and reduced environmental impact over time.

In Conclusion

The benefits of construction loans make them worthy of consideration, from increased property value, customization, reduced competition, and potentially lower interest rates to expert support and eco-friendly constructions. A construction loan may just be the right financing option for your next project.